A Single, Unified Western Market

Bonneville Power Administration has a key role

The West is in the midst of determining how to structure itself into electricity markets, with significant implications for utilities, customers, and the future of a clean, equitable, and affordable western grid. Electricity markets can coordinate and optimize the electricity grid, creating a system that is more reliable, can transition to clean energy faster, and will have notable savings for customers.

We’ve written about markets before. If this is a new topic to you, we highly suggest reading our previous posts about markets:

- Markets Month Part 1: What are energy markets and why are they important?

- Markets Month Part 2: Developments to create a western electricity market

- Markets Month Part 3: Why past efforts have failed, what’s changed, and how to structure markets

- Western Market Benefits to the Northwest

It’s crunch-time for key stakeholders in the West to make decisions about which of two electricity markets they plan to join: Southwest Power Pool’s (SPP) Markets+ or California Independent System Operator’s (CAISO) Extended Day-Ahead Market (EDAM).

One of the most important stakeholders, the Bonneville Power Administration (BPA), is currently hosting a public review process from July 2023 to March 2024 to determine its participation in either of the day-ahead market offerings. This process is an opportunity for a regional leader to acknowledge the importance of, and bring the region together towards, a single, unified western market.

One market or two

Conversations about joining Markets+ and EDAM have tended to consider the situation only as a bakeoff between two competing proposals. The overarching question before us is not which of the two market offers to pick, but whether the West will have one big market or two smaller markets. No matter how good the governance, market design, and greenhouse gas accounting may be in each market offer, there is credible analysis showing that a two market outcome will dramatically decrease the benefits for customers across the entire western region.

If BPA chooses to step out of the Western Energy Imbalance Market (WEIM) to join a second market footprint, we are concerned that will trigger a long-term loss of value across the West. This is the most consequential decision facing the Western Interconnection in decades, and it is before us now.

Load and resource diversity

As the 2021 State Led Market Study demonstrated, the reduction of load and resource diversity with two major markets could result in a loss of a quarter or more of the net benefit compared to a single market, as measured by production cost (energy) and long term (capacity) savings.

The State Led Market Study is arguably conservative on the effects of a two-market outcome considering the accelerating changes we are now seeing for load, resources, and climate-amplified weather events. That in turn sharpens the focus on reliability risk, which is harder to measure directly but is paramount, as the heat wave in early September 2022 showed. Reliability is no longer an issue for one part of the region or another, it is a common concern for the entire Western Interconnection.

An outcome of two markets and the resulting loss of a quarter or more of total potential value will have effects across the board: higher dispatch costs, more congestion, greater reserve requirements, slowdown for clean energy integration, higher emissions, reduced reliability. It will increase costs for customers and impede achievement of climate, clean energy, and equity targets and requirements across the West.

Seams

Another important aspect of two market footprints is the complex set of issues called “seams.” Seams is not merely about congestion management and market-to-market impacts in operating time, it is also about the effects over the longer term for both resource adequacy and transmission expansion.

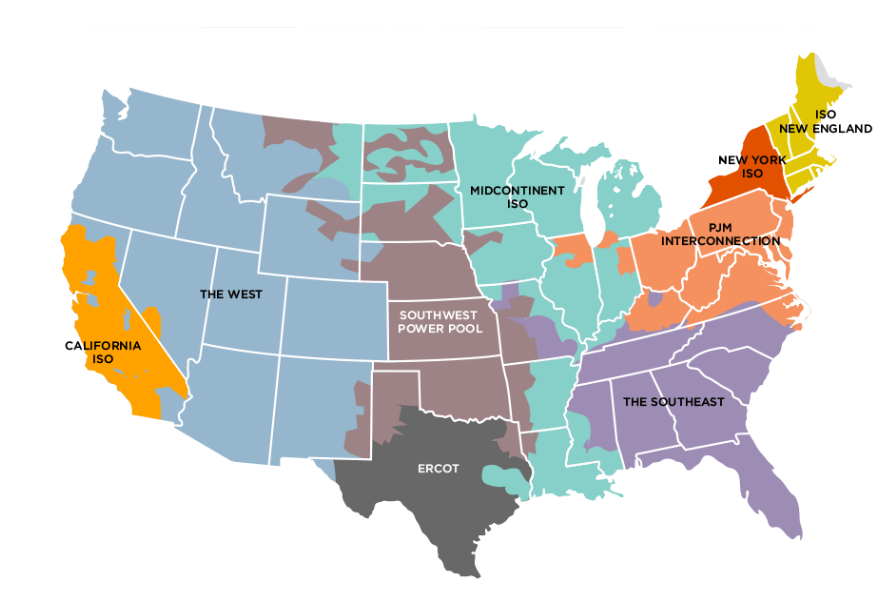

While it is said that two markets can have seams agreements and continue cross-seam power trade, the evidence from eastern Regional Transmission Organizations (RTOs, which are practically synonymous with Independent System Operators, or ISOs) is that seams effects are expensive, complex, and permanent.

The Regional States Committee of SPP and the Organization of Midcontinent Independent System Operator (MISO) States commissioned a multi-part seams assessment from Potomac Economics that was published three years ago. The review showed that, even 15 years after the initial Joint Operating Agreement by MISO and SPP, major gaps and alignment issues between the markets were causing seams burdens of well over one hundred million dollars per year, not including the time, attention, and costs for market operators, participants, regulators, and stakeholders. For day-ahead markets and RTOs, seams create a massive, never-ending effort to analyze and negotiate reforms that are never entirely satisfactory.

With our long transmission supply lines and already diverse load and resources, the West has much higher vulnerability to seams effects. Looking at potential boundaries for Markets+ and EDAM, it is obvious that seams management would require extraordinary effort. Just one of the complexities would be seams interchange issues including dynamic transfers, pseudo-ties, wheelthroughs, and reliability concerns such as unscheduled flows.

Furthermore, the complex boundaries between major transmission owners such as BPA and others will effectively result in two markets running on top of the same transmission in many locations across the West. We must be serious about a full understanding of the potential costs and risks that this would entail.

No Way Back

The choice of one market or two for a day-ahead market is effectively a permanent dividing line for the West. Because day-ahead markets commit and coordinate both transmission and resources for the day-ahead and real-time markets, they naturally create trading and planning zones that are self-perpetuating.

In the East, where much of the RTO-ISO map does not make much sense, very few utilities have moved from one market to another as development progressed from day-ahead markets to RTOs. And no serious proposals have been made to merge eastern RTOs and ISOs, even where it would make sense.

The path dependence of the day-ahead step followed by RTO formation strongly suggests that if the West goes to two major day-ahead markets, that will be our permanent condition.

Our existing bilateral markets and the WEIM are already sending a strong signal not to go down that road. Today, power flow between the Northwest and California is no longer a one-way street. Rapid shifts in demand shape and load growth, the changing resource mix, wholesale gas price volatility and climate-amplified weather conditions are already pointing toward a future of increasing interdependence to keep the lights on.

FERC Standard of Review

Finally, this is not only our view. More than two decades ago, in Order 2000, the Federal Energy Regulatory Commission adopted four characteristics and eight functions in their standard of review for RTO filings. Order 2000 remains Commission policy, and we believe they will apply the Order 2000 lens to the day-ahead filings going forward.

In its lengthy discussion of Characteristic 2, Scope and Regional Configuration, the Commission summarizes:

“We conclude that a large scope is important for an RTO to effectively perform its required functions and to support efficient and nondiscriminatory power markets. Adequate scope is not necessarily determined by geographic distance alone; other factors include the numbers of buyers and sellers covered by the RTO, the amount of load served, and the number of transmission lines under operational control. The scope must be large enough to achieve the regulatory, reliability, operational and competitive objectives of this Rule . . .

One of our concerns about an RTO’s scope is that existing impediments to trade, reliability, and operational efficiency be eliminated to the greatest extent possible. However, an RTO application that proposes to rely on “effective scope” to satisfy Characteristic 2 must demonstrate that the arrangement it proposes to eliminate the effect of seams is the practical equivalent of eliminating the seams by forming a larger RTO [emphasis added].”

In adopting Order 2000, the Commission noted concerns from the West about the feasibility of implementing a single market at that time. But that was a quarter century ago, and today we have the WEIM covering over 80% of the loads and resources in the west.

Unite the West

We already have the foundation for a single organized market with the WEIM. We must review and thoroughly understand what the potential losses and risks are for a two-market result, and see if it is even possible to mitigate that.

On July 14, a group of western state utility commissioners proposed a new approach to manage EDAM and potentially, a regionwide RTO in the future. A new, fully independent market would be formed, building on the governance principles that have been worked on for several years by western states and provinces. CAISO would continue to manage the California grid and participate in state resource adequacy and transmission planning, while providing regional market services under contract to the new western system operator. This could be the key step in securing a single major market footprint for the West and achieving full customer value and climate, clean energy, and equity goals.

In the words of Brian Silverstein, former BPA Transmission Vice President, we are all part of one big grid. Now is the time for the West to pull together, not apart.

BPA has the ability, and the obligation, to take on the full picture of this western market decision and be a leader in that effort.