Markets Month: Part 1

Welcome to Markets Month! Over the course of the next month or so we’ll be publishing a multipart series about electricity markets in the Northwest. We hope to cover the basics and keep you up to date on the processes occurring in the region to develop an integrated western electricity market system.

Part 1: What are energy markets and why are they important?

What are energy markets?

“Energy market” can mean many things. For the purposes of this series, we will be referring to the spectrum of ways that electric power can be bought and sold.

Broadly speaking, energy markets can be divided into “bilateral markets” and “organized markets.” In bilateral markets, utilities purchase electric energy services from each other or third parties in a bilateral way through a contract. For example, Puget Sound Energy might buy surplus power for a short period from Seattle City Light. Or, PacifiCorp might purchase power from a wind farm developer through a long-term power purchase agreement. As technology has improved, and the clean energy transition has quickened, there are now more opportunities for innovation in the way wholesale power is bought and sold in the Northwest – including expansion of organized markets.

In contrast to bilateral markets, “organized markets” are designed to optimize the balancing of electricity demand and electricity generation through efficient dispatch of energy resources participating in a given market. These markets are typically operated by an Independent System Operator (ISO) or Regional Transmission Operator (RTO). Unlike utilities, RTOs and ISOs – the names effectively refer to the same thing – don’t own any generation resources or transmission; instead, they manage markets, operate the transmission system, and balance the electricity system to ensure demand is met by generation. They are also responsible for ensuring resource adequacy and adequate transmission. These RTOs/ISOs manage and optimize all loads and energy resources in a given area via multiple market auctions.

When utilities join an RTO or ISO, they pool their resources and participate in a single balancing area authority (BAA). Much of the nation is organized into RTOs or ISOs, but most of the West is not, relying on 38 separate balancing authorities. Some RTOs and ISOs are single state entities, such as the Electric Reliability Council of Texas (ERCOT) or the California ISO (CAISO). Some are multi-state entities, such as New England ISO (ISO-NE) or the Midcontinent ISO (MISO). In the absence of an RTO or ISO, it is states that have inherent authority over resource adequacy, so convincing states to relinquish that authority and join a multi-state RTO or ISO can be challenging.

Within an RTO/ISO, there are actually multiple markets, each designed to accomplish a specific purpose. One major type of market is referred to as “real-time” and runs within every hour to match supply with changing electricity demand that must be balanced at all times. Other markets are “day-ahead,” setting the amount of supply to match energy demand forecasts for each hour of the following day and allow generators time to prepare for operation. While day-ahead and real time markets can be separate, in most RTOs/ISOs they are combined into an overall system which may include more specialized markets, such as ancillary service or capacity markets.

Why are energy markets important?

Energy markets play an important role in our region by enabling our electric system to shift to a diverse portfolio of clean energy resources. Organized markets allow our utilities to take advantage of resource and demand diversity across a larger geographic area, so the bigger the market footprint, the better. In addition to Washington and Oregon in the Northwest, other Western states with 100-percent Clean Energy Standards include California, Nevada, New Mexico, and Colorado. As utilities begin to transition to 100-percent clean electricity, and more clean energy resources are built to replace retiring coal plants, expanded markets can facilitate the buying and selling of a larger mix of clean energy resources across the West.

For example, excess solar power from California in January can help Washington residents power their heating systems. Surplus hydropower from Washington in June can power AC units in Idaho during a heat wave. Markets can also help facilitate the buildout and integration of variable clean energy, like wind and solar, since energy can be dispatched to wherever it is needed in the moment, across the market’s footprint.

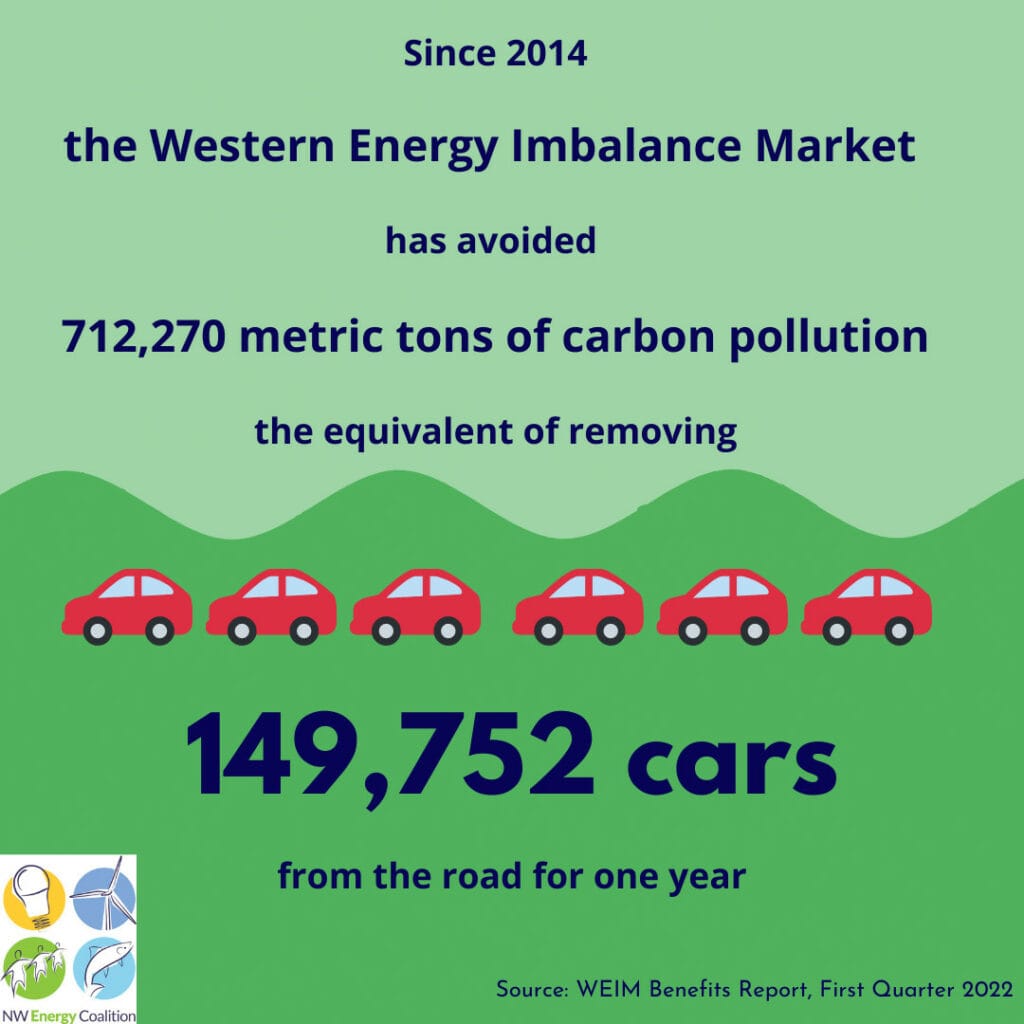

A very successful example of how markets can help states meet their climate and clean energy goals is the Western Energy Imbalance Market (WEIM), which has avoided 712,270 metric tons of carbon pollution, the equivalent of removing 149,752 cars from the road for one year.

Furthermore, because markets allow for more efficient dispatch of electricity across an area, they can reduce the need for new peaking capacity and improve reliability of the energy grid. For example, if a utility in Washington is facing high winter demand during a cold snap, the utility can look to the bilateral market (such as the “Mid-Columbia hub,” which has standardized contracts) to buy energy in order to meet that high demand. The utility can buy excess wind power from a utility in Oregon, where the weather may be less severe.

In an “organized market,” like the WEIM or a future western RTO/ISO, the market automatically enables all participating utilities to meet demand by accessing the full diversity of resources across a larger geographic area, creating efficiencies for both buyers and sellers. The larger the geographic area, the greater potential for a diversity of resources, and the more savings for customers. Larger market footprints also mean more complexity, requiring significant effort to find common ground among participants that are subject to different energy policies and that own different types of resources. But as the WEIM shows, the additional effort pays off with substantial improvements in costs, reliability, and reduced emissions.

This greater diversity of resources also improves reliability. For example, if a utility’s gas plant must shut down for safety concerns, the market operator will dispatch replacement power from the best source across the footprint. Ideally, markets can be designed to enable participation from demand-side resources as well, so that customer load can respond to market signals and be flexibly managed by utilities or customers themselves to optimize the system as a whole.

Moving to a more integrated western electric system will significantly advance rapid decarbonization for the region. If designed properly, organized markets can pave the way for a more resilient system, more affordable energy services to customers, and financially healthier utilities.

The devastating impacts of climate change we are now witnessing have heightened the urgency to design effective energy markets as part of a strategy to decarbonize our electric system. We are at a pivotal moment. We are hopeful that today’s challenges will lead to breakthroughs in developing a strong, open, and fair western energy market.

Efforts are underway to create a more integrated electricity grid in the West, and several key players are prioritizing the expansion of organized markets. The following is a list of entities that play a significant role in these discussions:

- CAISO: The California Independent System Operator is in charge of operating most of the California electric grid, balancing the system to ensure reliability and operating the real-time Western Energy Imbalance Market (WEIM).

- WEIM: The Western Energy Imbalance Market is a real-time market operated by CAISO and serving balancing areas throughout much of the western grid to allow participants to buy and sell power close to the time electricity is consumed. The WEIM manages congestion on transmission lines, supports integrating renewable resources, and helps to use excess renewable energy rather than curtailing it. It was launched in 2014, currently has 17 members, and just recently reached the milestone of delivering $2 billion in benefits for its participants.

- EDAM: The CAISO Extended Day Ahead Market would be an expansion of WEIM to day-ahead electricity trading. While still in development by CAISO and stakeholders, the EDAM could significantly increase benefits for participants if structured correctly.

- WRAP: The Western Resource Adequacy Program is managed by the Western Power Pool (WPP). It does not include a market, but it enables resource sharing between members and ensures that utilities have adequate energy supply at all times. It currently has 26 participants across the West from British Columbia to Arizona to South Dakota.

- SPP: The Southwest Power Pool is an RTO that oversees reliable electricity supplies and adequate transmission infrastructure, and operates across 17 states. Most of SPP’s footprint is in the Midwest and the Southwest, but SPP also operates a Western Energy Imbalance System for utilities in the Western Interconnection.

- Markets+: Markets+ is SPP’s most recent effort to expand into the Western Interconnection. It is still being developed and would be a day ahead market for utilities in the west.

In our next Markets Month in May edition, we will explore the important processes that are occurring across the West to build a fully integrated western electric market system.