Markets Month: Part 2

Welcome to Markets Month! Over the course of the next month or so we’ll be publishing a multipart series about electricity markets in the Northwest. We hope to cover the basics and keep you up to date on the processes occurring in the region to develop an integrated western electricity market system.

Part 2: Developments to create a western electricity market

In Markets Month: Part 1 we explained what energy markets are and why they’re important, and we identified several entities that are key players in discussions about creating an integrated western electric system. In this post, we’ll break down each entity, what processes they’re engaged in, and how advocates can be involved.

CAISO, WEIM, and EDAM

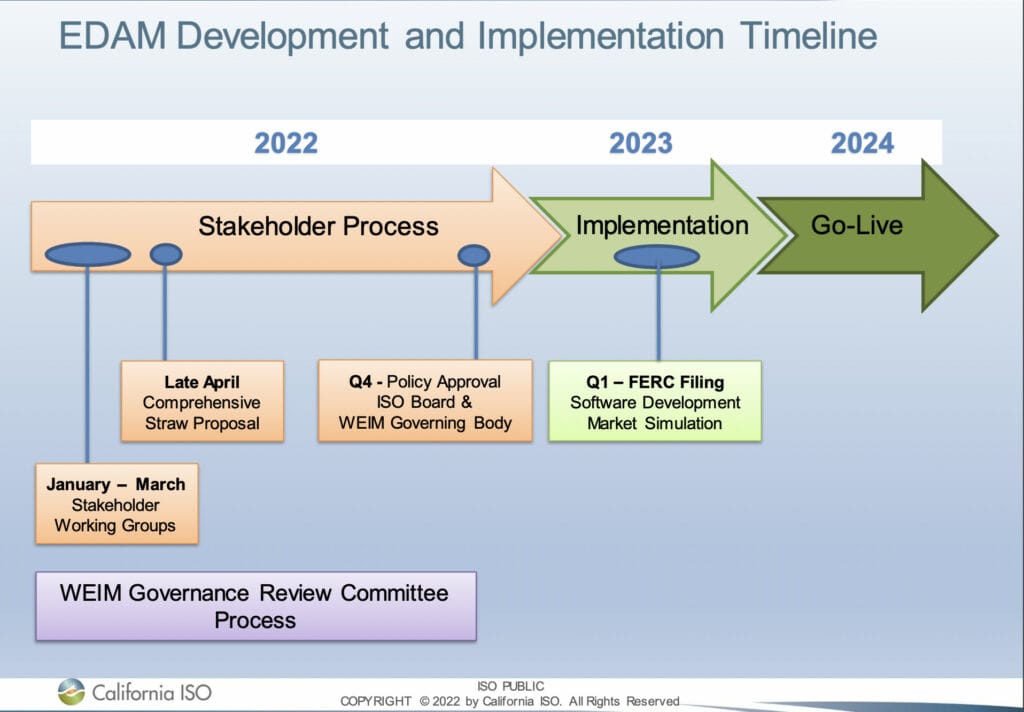

The California Independent System Operator (CAISO) operates the Western Energy Imbalance Market (WEIM) and is in the process of expanding WEIM into an Extended Day Ahead Market (EDAM). That effort is being managed through CAISO’s Stakeholder Process. After extensive workshops in the early part of 2022, CAISO issued a straw proposal on April 28 that can be viewed here. There was a two-day conference on May 25-26 to review the proposal, and written stakeholder comments are due on June 16. Later in the year, more revisions will be proposed and it is expected the EIM Governing Body and CAISO Board will consider a final proposal near the end of 2022. Meeting information, supporting materials, and any updates will be posted to the EDAM page. If approved, CAISO will file the final proposal with the Federal Energy Regulatory Commission (FERC) and prepare for the launch of EDAM in 2024.

In parallel with EDAM design, the WEIM and CAISO created a Governance Review Committee to propose a governance proposal for an expanded Governing Body. Currently, the CAISO is overseen by a Board of Governors formed under California state law. Creating an expanded Governing Body for the EDAM would allow for necessary oversight by representatives from other participating states and representing diverse interests. This important governance reform is essential for a functional, accountable, and robust market.

NW Energy Coalition is an active participant in the EDAM process and we see significant potential that this could be the crucial next step toward developing a fully integrated western electricity market. While significant governance and operational issues remain to be sorted out, in our view the success of the EDAM will provide working experience and build trust to support a rapid move in that direction.

SPP and Markets+

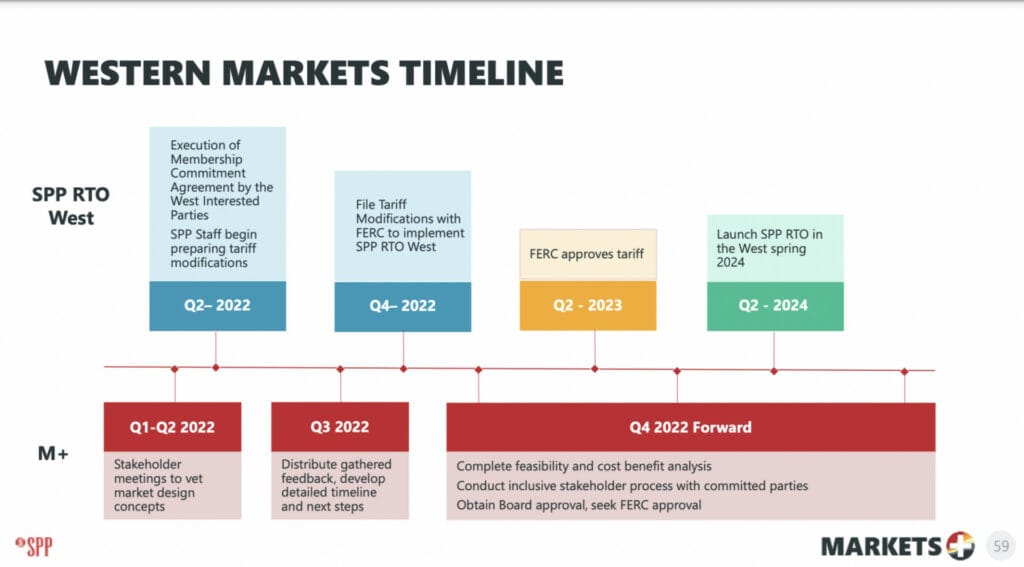

The Southwest Power Pool (SPP) became an RTO in 2004 and launched an Energy Imbalance System in 2007 for its members in the Eastern Interconnection, mainly in the Midwest and Southwest. In 2019, SPP turned its attention towards the Western Interconnection, launching western reliability coordination services. That was followed by the real-time Western Energy Imbalance Services (WEIS) market in 2021, which serves several utilities in Colorado, Wyoming, Montana, South Dakota, and Nebraska as well as the Western Area Power Administration. SPP is now developing a Western RTO and a day ahead market called Markets+.

In July of 2021, the SPP’s Board of Directors approved terms and conditions for RTO expansion into the Western Interconnection. Fifteen utilities, including nine from the Northwest, have formally announced their intent to evaluate membership in SPP’s RTO West against CAISO’s WEIM.

SPP’s day ahead market, Markets+, is under development and participation is open to any interested stakeholder. The next Markets+ development meeting is on June 1 and 2. Information for that meeting can be found here and supporting materials and updates will be posted on the Markets+ Development webpage.

In NW Energy Coalition’s view, it is key to resolve the unbalanced governance structure of SPP, improve transparency and access to non-utility stakeholders, and fully include demand response and other customer side resources as SPP moves into the West and Northwest.

State collaboration – WIEB, CREPC, and WIRAB

The Western Interstate Energy Board (WIEB) is composed of 11 western states and 2 western Canadian provinces, each of which appoints one member to the Board in addition to an ex-officio member appointed by the President of the U.S.. WIEB develops and promotes energy policy cooperatively between its members that benefits the West.

The Committee on Regional Electric Power Cooperation (CREPC) is a joint committee of WIEB and the Western Conference of Public Service Commissioners. It does not have a formal membership and is composed of public utility commissions, energy agencies, and state consumer advocates in the footprint of WIEB. CREPC works to improve efficiency of the western electric system.

The Western Interconnection Regional Advisory Body (WIRAB) was created by the Federal Energy Regulatory Commission (FERC) in 2006 to advise FERC, North American Electric Reliability Corporation, and the Western Electricity Coordinating Council (WECC) on issues pertaining to reliability in the Western Interconnection. Membership in WIRAB is composed of all states and provinces with load served in the Western Interconnection.

WIEB, CREPC, and WIRAB are important forums for states to cooperate on western electricity market issues. This Spring, at the Joint WIRAB-CREPC meeting, there were several panels on market issues, from governance to transmission.

Industry collaboration – WMEG

The Western Markets Exploratory Group (WMEG) is a group of 14 western utilities, including many in the Northwest, that joined together to evaluate the potential of joining regional market structures in a staged approach. WMEG hired a consultant this Spring to develop a roadmap by the end of the summer that will identify market solutions to achieve decarbonization, while maintaining reliability and affordability. The 14 utilities represent over 13 million customers and 70,000 MW of load, and many of them are involved in CAISO’s WEIM or SPP’s WEIS.

State-level Action in the Northwest

State-led Market Options Study (Multi-state): In July 2021, the U.S. Dept. Of Energy published a study led by the State Energy Offices of Utah, Idaho, Colorado, and Montana, evaluating the potential benefits of a West-wide organized market. The study culminated in the publication of a final “Roadmap,” including a Technical Report and Market and Regulatory Review Report. The study was undertaken with participation from representatives from Arizona, California, New Mexico, Nevada, Oregon, Washington, and Wyoming. The technical assessment was conducted by Energy Strategies and compares the benefits of different power market configurations for the west. It shows that a single market annually offers hundreds of millions of dollars of greater benefits across the region compared to dual markets or the current situation where most of the west is outside a full market.

SB 589 (Oregon): During the 2021 Legislative session, Oregon passed SB 589, which required the Oregon Department of Energy to conduct a study identifying the opportunities, challenges, and barriers to Oregon entities participating in an RTO. The Final Report was published and submitted to the Oregon Legislature in December 2021.

Markets Workgroup (Washington): Under the 2019 Clean Energy Transformation Act (CETA), the Utilities and Transportation Commission and the Dept. of Commerce initiated a carbon and electricity markets stakeholder work group. A summary report detailing the workgroup’s activities was filed with the UTC in May 2021.

The process for creating a well-functioning market can be complex, with many stakeholders bringing different principles to the table. We are excited to see the momentum gathering for a more integrated electricity system in the West. While these efforts are more organized and farther along than ever, we must remain steadfast in our values to ensure the best possible western electric market for our region. In Part 3 of our Markets Month series, we’ll lay out the principles any successful western market must follow.