Markets Month: Part 3

Welcome to Markets Month! Since mid-May, we’ve been publishing a multipart series about electricity markets in the Northwest. We hope to cover the basics and keep you up to date on the processes occurring in the region to develop an integrated western electricity market system. Check out Part 1 and Part 2 of the series.

Part 3: Why past market efforts have failed, what’s changed, and how to structure markets

In Markets Month: Part 1 we explained what energy markets are and why they’re important. In Markets Month: Part 2 we explored developments in creating a western electricity market, including the players and processes. In this post, we’ll look at why past efforts to create a western electricity market have failed, how conditions have improved, and identify several key components of any successful western market.

Past efforts at creating an organized market in the Pacific Northwest have failed and there are lessons to be learned

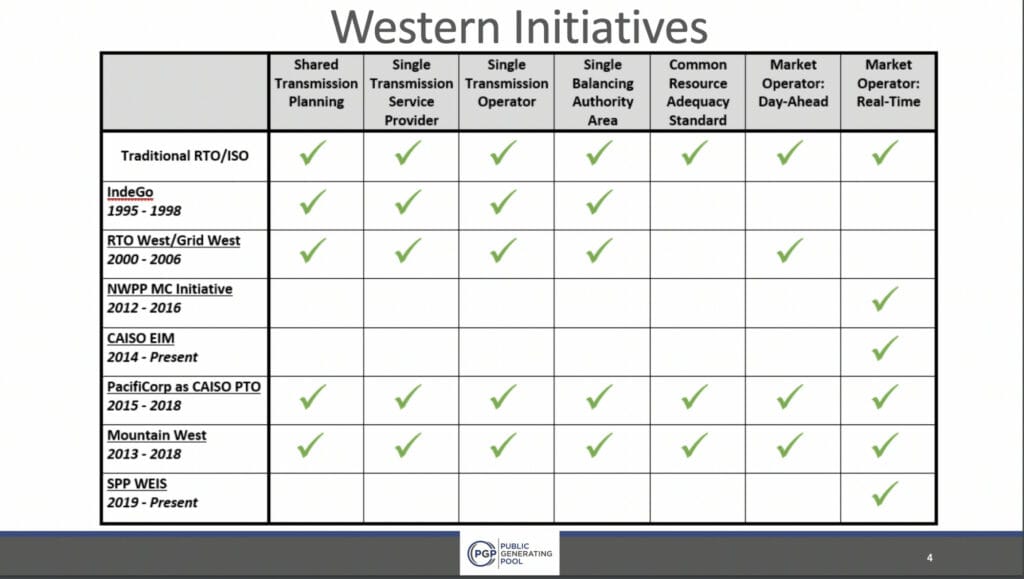

National efforts to deregulate the energy industry in the mid 1990’s led to a history of attempts to form an organized electricity market in the Pacific Northwest and the West. However, with two exceptions, most of those efforts have failed (see Markets Month: Part 2 for discussion of SPP WEIS and CAISO WEIM). Figure 1 shows a comprehensive list of prior Western electricity market initiatives.

About two-thirds of electricity consumers in the US are served by RTOs or ISOs, which operate power markets and manage regional grids. But the Northwest does not have an RTO or ISO. There are a multitude of reasons why past attempts at creating a Northwest market have failed:

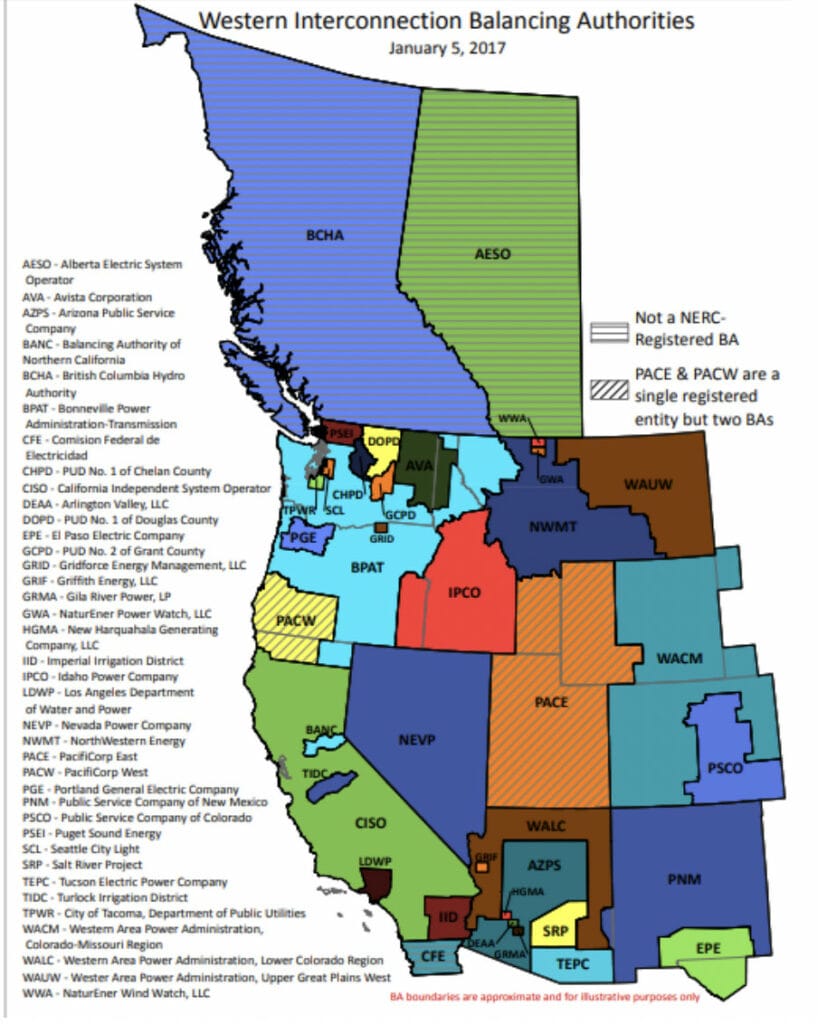

- Depending on the footprint of the market, up to 38 Balancing Authority Areas (BAAs) in the Western Interconnection and 17 BAAs in the four Northwest states would have to relinquish their function, losing control over reliability and undergoing significant internal change, in order to form one BAA under an ISO or RTO.

- The 2001 Power Crisis and dysfunction in CAISO’s market structure had severe financial consequences which has caused many regional utilities to approach new market design attempts with apprehension. Much has changed in the following two decades, including successful renovation of CAISO’s market structure that has been in operation for over a decade, and allowed development of the Western EIM and the proposed Enhanced Day Ahead Market (EDAM).

- The Bonneville Power Administration (BPA) is the transmission provider for about three-fourths of high-voltage transmission in the Northwest. A Western RTO or ISO would overlap with BPA’s footprint and would require a strategy for resolving differences in transmission rates so that far larger economic and reliability benefits of regional coordination could be achieved.

- BPA is a federal agency and its participation in an organized market would need to ensure that it can continue to meet its legal obligations. Also, BPA’s preference power customers would have a large say in BPA’s decision to join an organized market, and may not draw the same conclusions as BPA as to the benefits of joining a market. But it’s important to note that after extensive legal and operational analysis and thorough review with their customer utilities, BPA successfully entered into the Western EIM in May 2022.

While some of the above facts remain true today, many other factors have changed in the last 20 years.

Today’s conditions are significantly different and interest in a western electricity market is high

Over the last two decades, the environment to create a western electricity market has dramatically improved. As we said in Markets Month: Part 1, Washington, Oregon, and a handful of other Western states have passed 100-percent Clean Energy Standards. The rapid development of renewable energy sources and phase-out of fossil fuel generation will require utilities to seek additional sources of flexible generation to complement the variability of renewable energy sources. Furthermore, it is likely that the hydropower that the Northwest has relied on for flexibility for decades will have capacity and generation timing shifts with the effects of climate change. Load diversity from across the region (for example, wind in Montana or solar in the Southwest) is demonstrating its value to help meet demand. And there is rapidly growing potential to capture benefits from customer side resources such as rooftop solar, demand response and additional energy efficiency. Markets are the best way to access load and resource diversity across large footprints, increasing appetites for a western electricity market.

Transmission trends, often talked about as a barrier to the renewable energy revolution, are also increasing the appeal of organized markets. As independent power producers become more common, demand for transmission access is growing, especially since large swaths of renewable generation are located away from load centers. Combining transmission operation under a single organized entity, such as an RTO or ISO, can lead to the most efficient use of transmission.

The above trends will only continue to accelerate in the coming years. As we laid out in Markets Month: Part 2, utilities and important entities in the power industry are approaching an integrated western electricity market with curiosity at worst, and open arms at best. But, in order to maximize the Northwest’s benefits from an organized market, we urge decision-makers to adopt several key principles.

Any successful Western market must have these key components

As dialogue and processes around a regional organized market heat up, we are focusing on several key components that, in our view, must be contained in any market structure. These components will ensure that the entire region will benefit from an organized market.

- The final footprint of the organized market must be West-wide. While the development process of a West-wide market may be more complex, the benefits to the region are much larger than a Northwest-only footprint. A Northwest-only market will severely slow expansion of clean energy resources, increase costs, and will not provide the reliability that the electric system needs because of the more limited geography and the impact that has on the value of the energy sources. A Northwest-only footprint increases the likelihood that utilities and regulators will continue to rely on developing new fossil gas generation to address reliability and resource adequacy challenges.

- Governance of the organized market must be independent. The board of directors that oversees a western market must be independent, diverse, and represent all stakeholders that will be impacted by its decisions, including – but not limited to – utilities, states, and public interest organizations. In April, regulatory commissioners from Arizona, California, Colorado, Idaho, Montana, Nevada, New Mexico, Oregon, Washington and Wyoming signed a letter supporting several principles for governance of a Multi-state Electric Organization in the West. For more on market governance, read this great opinion editorial from Nicole Hughes at Renewable Northwest.

- The market must reflect the full value of customer-side and community clean energy resources, and it must be structured to attract those resources into the market. Current regional markets consider customer side resources as peripheral, but a clean and integrated grid must fully incorporate them as resources on a level playing field with supply-side resources. Customer-side resources like demand response, distributed generation, and energy storage can substantially decrease overall system costs, increase system stability, promote equity and affordability, and reduce carbon pollution. To achieve this, large electricity customers, as well as their service providers and utilities, must see effective participation signals and compensation for their renewable and clean energy resources.

- Participation in the development and governance of the market must be fully open to public interest organizations. Public interest organizations represent customers and the general public. They must have a full voice and meaningful participation in the development and governance of a western electric system that is built on transparency and a commitment to supporting state-based clean energy goals.

The Northwest has been a clean energy leader in the U.S. for decades. We are now presented with an opportunity to continue that leadership by creating a West-wide RTO or ISO. Organized markets under an RTO or ISO will allow us to build renewable energy across the Northwest, capture load diversity and transmit power to where it’s needed, accelerate decarbonization of the entire economy, and lower costs while improving reliability. While discussions about an integrated western grid have been slowly underway for years, we are at a pivotal moment when those conversations could be accelerated and lead to tangible actions that benefit the entire region, or they could be postponed and hinder any advancement in this area. Together, Northwest regulators, stakeholders, and utilities must actively shape a strong and diverse clean electricity system that addresses resource adequacy and reliability without developing new fossil gas generation.