Western Market Benefits to the Northwest

The West is in the midst of determining how to structure itself into electricity markets, with significant implications for utilities, customers, and the future of a clean, equitable, and affordable western grid. Electricity markets can coordinate and optimize the electricity grid, creating a system that is more reliable, can transition to clean energy faster, and will have notable savings for customers.

A 2021 study analyzed the potential benefits of several different organized market configurations, coming to the conclusion that a single West-wide Regional Transmission Organization (RTO) will have the greatest benefits for the West.

Moving forward with a broader western market and RTO would provide between $700-885 million in annual benefits for Northwest states. The analysis in this state benefits study indicates clear benefits for a single western RTO. No other configuration can provide access to the full diversity of demand and generation across the West, especially given the important contributions that will be made by hydropower from the Northwest, solar in the Southwest, and wind in the Intermountain region.

The importance of electricity markets

Much of the nation’s electric system is organized into RTOs or Independent System Operators (ISOs) that coordinate the balancing of electricity generation and load, and optimize the overall system for reliability and affordability (Figure 1). However, outside of the California Independent System Operator (CAISO), most of the West is not organized into an RTO or ISO, relying on 38 separate balancing authorities.

Electricity markets can play an important role in the Northwest by making it easier for our electric system to shift to a diverse portfolio of clean energy resources and improve grid reliability.

In addition to Washington and Oregon in the Northwest, other western states with 100-percent Clean Energy Standards include California, Nevada, New Mexico, and Colorado. As utilities begin to transition to 100-percent clean electricity, and more clean energy resources are built to replace retiring coal plants, expanded markets can facilitate the use of a larger mix of clean energy resources across the West.

Furthermore, because markets allow for more efficient dispatch of electricity across an area, they can reduce the need for new peaking capacity and improve reliability of the energy grid. In an “organized market,” like the successful Western Energy Imbalance Market (WEIM) or a future western RTO, the market automatically enables all participating utilities to meet demand by accessing the full diversity of resources across a larger geographic area, creating efficiencies for both buyers and sellers. The larger the geographic area, the greater potential for a diversity of resources, and the more savings for customers.

Resource diversity can also include customer side resources, like demand response, rooftop solar, and battery storage. Including flexible, customer side resources can decrease the use of expensive gas peaking plants in favor of clean energy technologies.

Moving to a more integrated western electric system will significantly advance rapid decarbonization for the region. If designed properly, organized markets can pave the way for a more resilient system, more affordable energy services to customers, and financially healthier utilities.

Read more about what electricity markets are and their benefits on our website.

Benefits of a western market to the West and Northwest

In July 2021, the U.S. Department of Energy published a study led by the State Energy Offices of Utah, Idaho, Colorado, and Montana, evaluating the potential benefits of a West-wide organized market. The study was undertaken with participation from representatives from Arizona, California, New Mexico, Nevada, Oregon, Washington, and Wyoming, in addition to participants from the lead states. The assessment was conducted by Energy Strategies and compares the benefits of different power market configurations for the West.

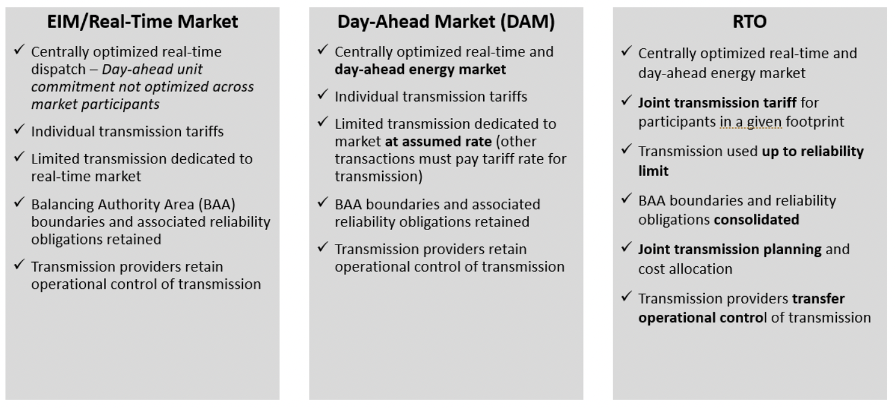

The assessment looked at several different market constructs, including real-time, day-ahead, and RTO (Figure 2).

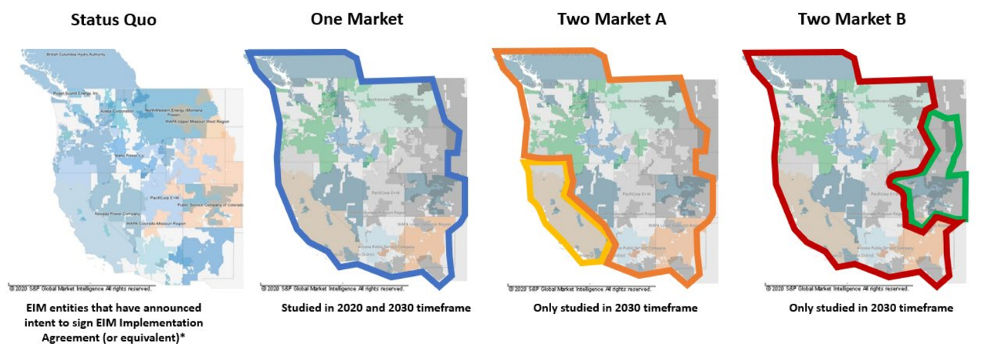

The assessment also looked at several different market footprints, including Status Quo (WEIM and Western Energy Imbalance Service – SPP’s real time market – only), One Market across the whole West, Two Market A (CAISO and SPP+), and Two Market B (CAISO–West and SPP-CO) (Figure 3).

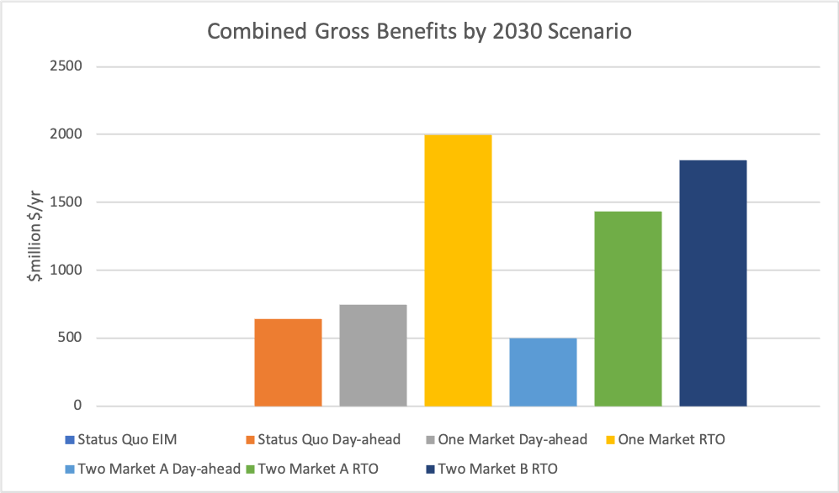

The assessment found that the West would receive significant benefits from all market configurations, and the greatest benefits from a One Market RTO. When combining capacity savings (due to load diversity) with adjusted production cost (APC), a One Market RTO would provide benefits of almost $2 billion (2018 dollars) annually (Figure 4). Compared to alternative RTO footprints, benefits of a One Market RTO are $569 million greater than Two Market A and $187 million greater than Two Market B.

How do the benefits of western markets apply to the Northwest states of Washington, Oregon, Montana, and Idaho (Figure 5)?

Washington would accrue the most significant benefits, seeing $551 million per year from a One Market RTO. It’s worth noting that alternative RTO footprints, Two Market A and Two Market B, would also provide significant benefits, at $456 million and $553 million per year, respectively.

Oregon would also accrue significant benefits: $207 million per year for a One Market RTO and Two Market B, and $160 million per year for Two Market A.

Montana would see benefits totaling $46 million per year for a One Market RTO, $42 million per year for Two Market B, and $14 million per year for Two Market A.

Finally, Idaho would witness gross benefits of $80 million per year for a One Market RTO, $83 million per year for Two Market B, and $70 million per year for Two Market A.

If we sum the benefits of each market configuration for the four Northwest states, the region could see annual benefits between almost $700 million to $885 million depending on what market structure is established.

Current landscape: CAISO EDAM and SPP Markets+

CAISO operates the Western Energy Imbalance Market (WEIM) and is developing an expanded Extended Day Ahead Market (EDAM). The WEIM matches generation and demand every 5 minutes within the hour. It now covers over 80% of the West and has provided more than $3.4 billion in savings since 2014. The EDAM would expand this intra-hour market and allow participating utilities to coordinate their systems a day at a time, providing much more opportunity to coordinate generation, storage, transmission, and demand. The WEIM Governing Body and CAISO Board approved the final proposal for EDAM in February 2023. The final EDAM proposal will likely be filed with the Federal Energy Regulatory Commission (FERC) and implementation will begin in early 2024. Meeting information, supporting materials, and updates are posted on the EDAM page.

The Southwest Power Pool (SPP) operates in the center of the country as part of the Eastern Interconnection. SPP turned its attention towards the Western Interconnection in 2019, launching western reliability coordination services. That was followed by the real-time Western Energy Imbalance Services (WEIS) market in 2021, which serves several utilities in Colorado, Wyoming, Montana, South Dakota, and Nebraska. SPP is now developing a Western RTO and a day ahead market called Markets+, and expects to launch them in stages.

The process for creating a well-functioning market is complex, with many stakeholders bringing different interests and viewpoints to the table. We are excited to see momentum gathering for a more integrated electricity system in the West. While these efforts are more organized and farther along than ever, we must remain steadfast in our values to ensure the best possible western electric market for our region.

Summary

The West is in the process of weighing several different market proposals. The State Led Markets Study shows that there is a clear path forward: a One Market RTO. The West has an opportunity to build on the success of the WEIM by expanding into a full RTO for nearly $2 billion worth of benefits every year. The benefits for the entire West, and individual Northwest states, are significant and clear.

The devastating impacts of climate change we are now witnessing have heightened the urgency to design effective wholesale electricity markets as part of a strategy to decarbonize our electric system. We are at a pivotal moment. We encourage policymakers, utilities, regulators, and advocates to weigh the benefits of a single West-wide market and commit to creating a strong, open, and fair West-wide market.